cash isa comparison

Just like standard savings accounts you can choose from different types of cash ISA. ISAs are not a qualifying product.

|

| The Cash Isa Paradox Rates Are Rising But Things Are Getting Tougher For Savers Aj Bell Youinvest |

Parents grandparents and friends can put money into a Junior Isa for a child each year up to a limit of 9000 in 2022-23.

. You can save up to 20000 in any one cash ISA each tax year which runs from April. Compare our best Cash ISA rates Get tax-free interest on your savings with a Cash ISA. Fixed rates might be for one two three or. You can only compare Cash ISAs including Help to Buy ISAs and Innovative Finance ISAs with GoCompare.

For the 2021-22 tax-year the maximum allowance is 20000. There are two main types of Cash ISA. A fixed rate ISA is a tax-free savings account where you get a guaranteed rate of interest for locking your money away for a set length of time. AJ Bell offers a Stocks Shares Lifetime ISA that allows deals in funds from 150 per deal and shares from 995 per deal.

Easy access Isa accounts allow you to withdraw funds without penalty. Easy access cash ISAs allowing you to withdraw your money whenever you need it penalty-free. You can use the sliders below to select how much you have saved each year in your tax free ISA and see what it is worth in real purchasing power today compared to having saved in real money Gold. Two-year fixed-rate cash Isas The highest rate for a two-year Isa is 245 AER from Charter Savings Bank.

Just like a normal savings account you can get cash ISAs that are easy access or fixed term. Best cash ISA rates Table. A cash Isa operates the same way as an. Three-year fixed-rate cash Isas The highest rate for a three-year term is 255 AER from Paragon Bank.

Whether youre looking to save 20 or 20000 a year our best ISAs have a range of rates terms and access options to suit your circumstances. Best easy access cash ISAs The best easy-access cash ISA rate without a bonus according to Moneyfacts is currently with Paragon which pays an annual interest rate of 135. This decision can be largely owed to Russias invasion of Ukraine which will likely push inflation in the UK higher. You can only deposit funds into one cash ISA per tax year.

A cash ISA is a savings account in which youll pay no tax on interest earned. Sorted by interest rate promoted deals first Updated daily. How to compare cash ISA accounts with MoneySuperMarket Browse our providers Just click the button below to see a list of all our cash ISA accounts Compare and choose View accounts from leading UK ISA providers and compare rates Click through to provider When you find the cash ISA you want click. You can read more about these on.

If youve locked your money up in a fixed-rate bond Cash ISA then you may have to pay a penalty in order to transfer the money into a new account. The decision could have an effect on your savings ISA mortgage and disposable income. Instant access or easy access cash ISA Notice cash ISAs Fixed-rate cash ISAs If you want to lock up your savings for a while you might want to consider a fixed-rate cash ISA. However it is worth familiarising yourself with the full range of charges that an investment platform will apply for.

Top 54 Cash ISA Providers Comparison A Cash ISA works in much the same way as an ordinary savings account except you do not pay tax on the interest you earn. The next-best rate is 243 AER from Castle Trust Bank. This limit was 4368 in 2019-20. In the table below we.

With A CD You Can Lock In Competitive Returns For Months Or Years With Minimal Effort. However compare cash ISAs now to find the right cash ISA for you. These offer a safe way of saving money in the short-term and are. Cash ISAs are savings accounts youll never pay tax on.

New ISA annual allowance for the tax year 20152016 was 15240. Use our comparison table below to see what rates they offer and read on to find out whether theyre worth it. What types of cash ISA are there. Opening a cash ISA is a good way to save for the future and gives anyone over the age of 16 to put away a significant amount of money.

While its impossible to predict the value of gold it is possible to state as inflation continues to increase any savings you have in fiat will. With a fixed-rate cash ISA the interest rate is fixed for a specific amount of time. In some cases you may get a slightly higher rate of interest in a fixed rate compared to an instant access ISA. Compare a variety of cash ISA providers Earn interest tax free Pay in up to 20000 each year View our cash ISA deals.

Ad Sit Back And Earn Up To 22X APY Than A Traditional Savings Account With A CD. AJ Bell does however charge an annual fee of 025. Compare Cash ISA Savings Accounts. These lock away your.

There are two types of ISA these are. A tax-free fund for your kids. That should make it easier to choose the right deal. Compare ISAs ISA is short for Individual Savings Account and allows you to earn interest tax free but youre limited to how much you can put in each year.

This makes them an attractive option for anyone who normally pays tax on their savings. Not everyones eligible for all types of ISA and the rules around each type of ISA account can change. You will be able to split the amount you pay into an ISA between a Cash NISA and a Stocks and Shares NISA as you choose up to the new overall annual NISA limit. The above Stocks and Shares ISA comparison heatmap calculates the cheapest ISA provider for you based on your ISA portfolio size as well as the assumption that you wish to invest in funds and make around 10 fund switches a year.

It offers an easy to manage account accessible 247 through the app or online with the ability to ask for help from its investment experts. Cash ISAs Basically the same as any other savings account except for the tax-free treatment. Cash ISAs are the direct equivalent of ordinary savings accounts that like savings accounts can be easy-access fixed-rate notice or regular savings accounts. You pay in money and earn interest on it.

There is a maximum amount of money you can deposit into a cash ISA per tax year. The current annual limit is 20000 meaning that you can deposit this. A Junior Isa is a childs version of a tax-free individual savings account Isa designed to encourage long-term saving for anyone under the age of 18. The Bank of England BOE raised interest rates today from 050 to 075.

|

| The Money Stats Cash Isa Interest Highest Level Since 2014 |

|

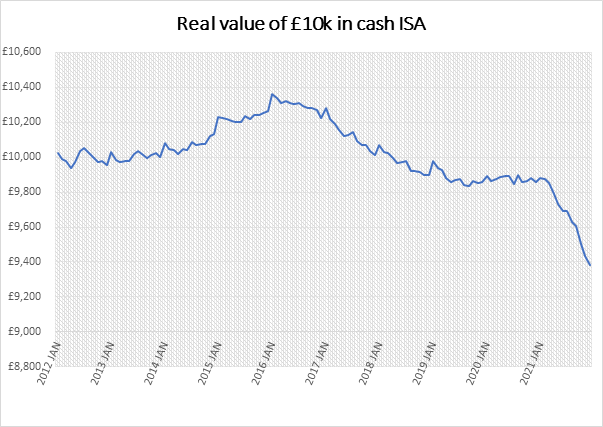

| A Lost Decade For Cash Isas In Numbers And Charts Aj Bell |

|

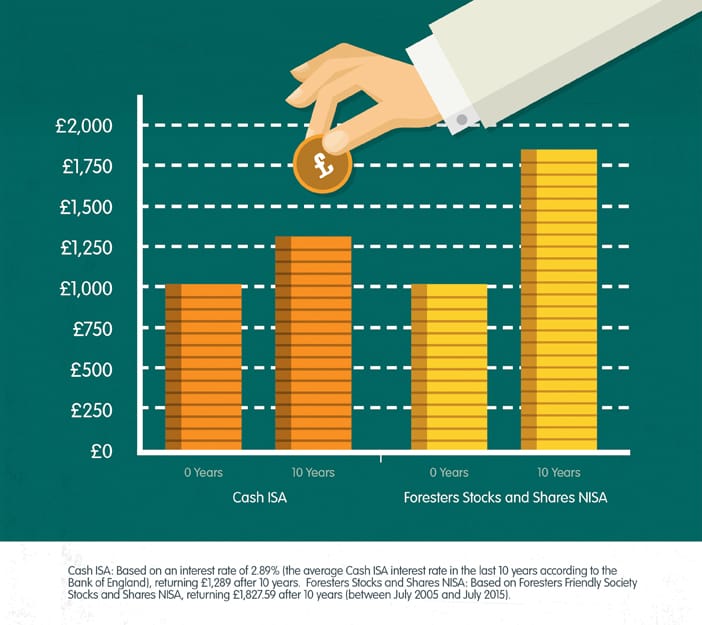

| Cash Isa Comparison With Stocks Shares Isa |

|

| Best Cash Isa Rates For Savers From Easy Access To Fixes Public News Time |

|

| Losing Interest With Your Cash Isa Here S A Simple Solution |

Posting Komentar untuk "cash isa comparison"